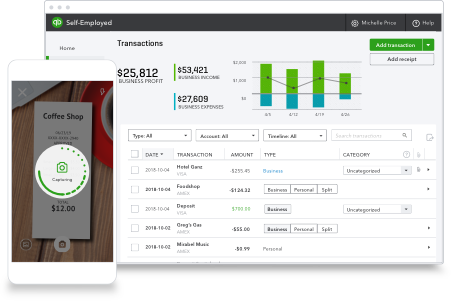

QuickBooks Self-Employed is the all in one finance app for self-employed workers, freelancers, sole-traders, contractors, and sole proprietors. QuickBooks Self-Employed finds tax deductions and keeps your finances organised by categorising your business.

2020-09-03 17:46:19 • Filed to: Quickbooks • Proven solutions

With Intuit QuickBooks self-employed, freelancer can save around 8 hours a month managing their finances. Here you can track mileage, save money by the mile, while also reserving the chance of driving up your tax deductions with automatic tracking. QuickBooks self-employed cost; QuickBooks self-employed has two pricing options – one that is just QuickBooks self-employed and the other which has QuickBooks self-employed Turbo Tax. On its own the software goes for $10 per month, while the one with Turbo Tax demands $17 per month.

QuickBooks Key Features

- Auto categorize expenses- QuickBooks self-employed app allows users to put transactions in to categories on the go. Here you can organize your finances with transactions getting matched to income and expenses automatically.

- Prepare self-assessment-With QuickBooks online self-employed, the user has a few perks. One of them includes getting an assessment that shows how much you owe in a detailed manner.

- Cash flow reports- One has the ability to see how much they are making. One can see a clear picture of their profits and business activity.

FreshBooks - The Better Alternative to QuickBooks

FreshBooks self-employed allows freelancers to work in a way that is streamlined by making accounting easy. Here users gain the ability of spending less time on paperwork and focusing on their passion. Freelancers are ushered in to a platform that allows them to charge their clients and manage their books. They also keep a detailed inventory that shows the items and goods they should focus on to make more profits.

Try Freshbooks for Free >>>Key Features of FreshBooks

- Easy invoicing- Freelancers on this platform get the chance to do away with manual invoicing. This is because the billable hours and expenses are added to the invoices automatically.

- Get paid faster- On Freshbooks, users get the chance to schedule and automate recurring invoices. This platform also allows users to build an online payment spot, where clients pay them directly on invoices in their web browser.

- Track receipts and expenses in an easy way- Users get the chance to take photos of receipts on their mobile apps, categorize them, assign them to clients and add the totals to invoices.

Quickbooks Self Employed Download Mac Os

Why Choose Freshbooks

The reason why freelancers and independent contractors should go for Freshbooks is the ability to deal with tax time in an easy way. During tax time most freelancers find themselves scrambling to prepare tax returns, with the deadline around the corner. Freshbooks provides a solution to this problem by letting you categorize expenses, prepare financial reports and collect information for tax time in a way that is easy. Freshbooks gives you a chance to file your tax early and in doing so you gain a couple of advantages. They include the ability to get your money faster in case you were expecting a refund or have more time to pay if you expect to owe. Also you avoid being a victim of tax fraud by filing before scammers have the chance to craft and submit one for you.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Quickbooks Self Employed Log In

Self-employed QuickBooks users have found billions in potential tax deductions using this automatic mileage tracker for work. Attach receipts to business expenses, create invoices and classify business expenses while separating from your personal finances and get all the tax refunds an independent business owner is entitled to!

Track mileage automatically

- Mileage tracking works automatically using your phone's GPS, without draining your phone's battery.

- Mileage data is saved and categorized to maximize mileage tax deductions.

Scan receipts

- The receipt scanner enters transaction information and easily stores receipts.

- Business expenses are automatically matched and categorized - saving you time and maximizing your tax refunds so you're ready for IRS tax time.

Expense Tracker to Organize Business Expenses

- Self-employed, self-employed or small business owner - manage your finances easily and stay current so you don't miss out on any tax deductions.

- Import business expenses directly from your bank account.

Receive your payment faster

- Create invoices and send them easily while traveling.

- Allow payments and bank transfer services to pay faster.

- Invoice Generator - receive a notification when invoices are sent, paid and money is deposited!

Stay prepared for tax time

- We do the math so you can avoid year-end surprises

- Easily organize income and expenses for instant tax filing

- Directly export income and expenses from List C.

- Instantly export your financial data to TurboTax Self-Employed by updating the tax package*.